Harvard University article about the state of the national housing market for 2021

The housing market is complicated and unbalanced due to Covid “supply side” economics as applied to the housing market. Housing shortages due to owner reluctance to sell, uncertainty of present and future jobs, and dramatically increased building supplies have created shortages and thus much higher housing prices. How long will this last? Is this trend coupled with historically low mortgage interest rates? Will this …

Tariff’s: Do they help businesses with global competition or are they killing American business?

They are killing American business. Tariffs sound like they should be a tax on other countries products, so American buyers are less likely to import foreign products. American companies can compete because American products are less expensive compared to the products produced by other Countries and our companies win. That is not exactly how they work. When the United States imposes a tariff on a …

How to Choose the Best Real Estate Company

The Best Real Estate Company What is the BEST REAL ESTATE COMPANY, or the BEST REAL ESTATE AGENT? Many companies and agents proclaim that they are the best. The reality is that among the 595 REALTOR ® MEMBERS and approximately 100 REALTOR® offices that serve this area there are strengths and weaknesses for all candidates. Let’s dig a bit and see what qualities are …

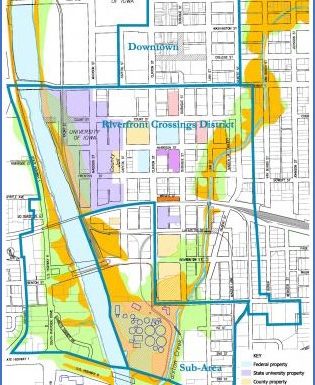

Welcome to Riverfront Crossings

A new neighborhood just south of downtown featuring a waterfront park with walking and biking trails, access to the Iowa River for boating and fishing, a variety of housing options near shopping, restaurants, jobs, a state-of-the-art recital hall and recreational facilities, just a short walk to Downtown Iowa City and the University of Iowa campus. Riverfront Crossings is well-situated for redevelopment. The district is ...

15-story Rise at Riverfront Crossings opens to student tenants, provides amenity-heavy lifestyle

(The 3rdand 4thfloor of the rise are currently offered for lease (or sale) under separate listing by Jeff Edberg, CCIM, SIOR IOWA CITY — Nearly 600 University of Iowa students now call an upscale high-rise home. Last month, tenants moved into Rise at Riverfront Crossings, a 15-story private student-housing development with more than 300 units. Rise is one …

Real Estate Investment provides a hedge for raising interest rates

Real estate mortgage interest rates have bottomed out several times since 2008 as a Federal Reserve tool to prop up a shaky economy. Lowering interest rates can be controlled to a degree by the Fed and provide for higher cash flow for real estate investments as less of the income is used to service loan debt. The Federal Reserve Discount Rate has been zero …

U.S. News & World Report: Iowa is #1 state in the country

Iowa is the #1 state in the country, according to a new study from U.S. News & World Report. Gov. Kim Reynolds appeared on CBS This Morning on Tuesday to make the announcement about the 2018 Best States ranking. “Our Best States ranking is a humbling tribute to our people who have proven time and again that in Iowa, if you’re willing to work …

The Greatest Bubble Ever: Why You Better Believe It, Part 1

I have been hearing predictions of the “bubble” popping for 9-months. This is a long and detailed read, but see what you think. If markets tank, investment real estate will be solid depending on overall liquidity in markets and the ability to finance. Real estate is always cyclic and always comes back. Happy New Year! Read full article here

What Is Building Information Modeling? 7 Stories That Illustrate the Best of BIM

BIM – Building Information Modeling seems to be the next big thing. It hasn’t hit Iowa City yet, but is all over news streams on the internet. Variations have existed for years on CAD systems, but it is reaching a critical mass and is about to go main stream. I’ll be watching this trend. Interesting! by Lara Caldwell Construction – May 3 2017 …